Mr Popodopolous

-

Posts

41862 -

Joined

-

Last visited

Content Type

Profiles

Forums

Store

Events

Posts posted by Mr Popodopolous

-

-

We have a crack of winning this at Middlesex now- they're 114/5- a lead of 84. If that happens it makes a West County derby in top flight a possibility- 3 go up after all.

Certainly with plenty of sides beating each other and us having games in hand, under the radar could be a way forward.

Some surprises in this League- Middlesex still bottom of the County Championship. 1 win in 8 before today.

Looking briefly at the top division- where hopefully we can be next season.

I struggle to see how Patel is a like for like for Nash- his batting is quite a bit superiod, historically at least and given he's a spin bowler too- not that he's bowling- he'll be more comfortable on a turning pitch.

6 down!

PS. Middlesex the sleeping giants of the 4-day game, to an extent Durham too but their success more recent- financially impaired too.

Glamorgan being top around the halfway point but more significantly with a reasonable margin in the top 3 is quite a surprise! Likely 2nd after this round. Middlesex being bottom well good odds back in April IMO!

-

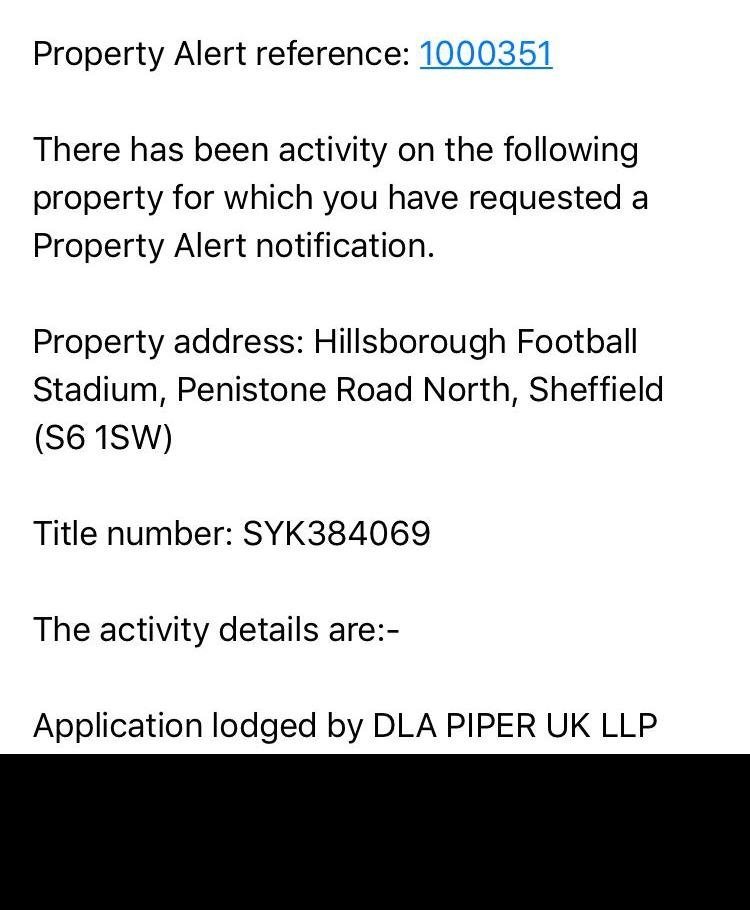

Oh yeah, plot thickens.

Sheffield 4 Limited voluntarily liquidated/wound up according to "Open Corporate". Or looking like it might be- 2nd July, maybe it takes a while to feed through to Companies House.

That would help to explain perhaps why Sheffield 5 Limited now "own" Sheffield 3 Limited as opposed to Sheffield 4 Limited doing so. Chansiri appears to be the ultimate controlling party in all cases though.

All 4- or soon to be 3 it seems- Non-trading companies too. To own assets or split payment of wages IMO.

-

Something interesting- possibly interesting- anyway on Sheffield Wednesday. I appear to have spotted it before Kieran Maguire but he can probably explain it better.

- Sheffield 2 Limited- Update. "Statement of Capital following an Allotment of Shares". £1,000 GBP.

- Sheffield 3 Limited- Now owned by Sheffield 5 Limited as opposed to Sheffield 4 Limited. The officer listed though is still Chansiri.

- Sheffield 4 Limited- Update. Statement of Capital following an Allotment of Shares". £1,000 GBP.

- Sheffield 5 Limited- Update. Statement of Capital following an Allotment of Shares". £1,000 GBP.

Additionally:

QuoteOn Sheffield 2 Limited and Sheffield 4 Limited

Non-cash consideration

"Shares allotted in consideration for the transfer of the entire issued share capital of SWFC Holdings Limited".

QuoteSheffield 5 Limited

"Shares allotted in consideration for the transfer of the entire issued share capital of Sheffield 3 Limited".

Maybe completely wrong but my initial guess is one of these is for a mooted sale and leaseback of Hillsborough and another 2 or 3 are for hiving off of salary costs but sufficiently small not to have to publish full accounts for each- parent/holding company surely either Sheffield Wednesday FC or Sheffield Wednesday Holdings- of which there is no sign. Maybe all of those full costs would be in Sheffield Wednesday Holdings- unclear if it's in transit, going to be based overseas or in UK.

Struggle to see how the share thing should make any substantial difference to FFP or the accounts beyond pushing up allowable losses from £5m + deductible costs to £13m + allowable costs which is the benchmark anyway surely, the ground thing might. The accounts incidentally which were originally due on February 28th 2019 for the period to May 31st 2018, 2 months moved- presumably to buy time so due at end of April. Been a few bank holidays since then but 2 months and a bit overdue even so.

-

201 all out at Middlesex.

Looks a result wicket- that's 4 bonus points and this is a game in hand, on some we even have 2. A must win this one of course but with 3 going up this season if we do...

-

Ohhh and something interesting from another forum- been on the cards for some while?

Will be interesting to a) See the benchmark ratio b) Whether it actually solves their issues- Reading's £6.5m profit was no fix really and c) What will come first- their 2017/18 accounts at Companies House or Sheffield Wednesday being allowed to sign, spend etc!

One more note to add on stadium sales and FFP.

Being 3 year rolling, it drops off the calculations after this season, and the transaction for Pride Park took place in 2017/18 reporting period.

Disregarding any fallout from Gibson legal action, or the Aston Villa thing leading to some sort of dispute over £81.1m price, discounting that, way the rolling system works means that if Derby don't go up this season, that profit drops off the calculations which makes for a bit of pressure? Not a huge amount but a bit.

-

2 hours ago, DerbyFan said:

I don't know re. the loan settlement.

There was a lot of work done on the academy, but I'm not sure on the timings of it, some may have been later, I'm also not sure if it would come under the Infrastructure Expenditure or the Youth Expenditure, it almost doubled in size area wise (I don't think the first team use the pitches in the new area, so that may come under the Youth?) and there were buildings added inside the main u-shaped one (which I assume everyone will use, so probably the Infrastructure?).

That article does say:

That could mean the replacement pitches (changed to hybrid), as I think they were installed at the same time as the stadiums, and not the brand new ones in the newly acquired area, which is the bit I think could have been later.

Re. 4, I know we do a lot of Community work, but I've no idea of the costs involved.

It's hard to say IMO. I have had, though I might be wrong the Academy Expenditure down as operational spending- i.e. cost of running it to that category, whereas Infrastructure would be improvements to it, the ground other factors- overall Expenditure- possible I'm double counting in some places though!

Are the Training Centre and Academy as one, concurrent? Assuming yes- most clubs are now.

Yeah we can only guess on that one really- and the same for Derby FC Women's team.

On your academy expenditure I did a search of financial results Derby and it did suggest- well a below the line commenter did anyway, called "hkram" that your academy expenditure is/was £5.5m per year! Like I say, never been so sold on Derby failing FFP without the ground transaction, using these results- the Sevco 5112 results may show a different story.

@downendcity Yeah they may well have provisions. Failing that, quite possible that expenditure on the ground wouldn't show in the club accounts as such- but they can spend on other areas of Fixed Assets e.g. Training Ground, academy which would all come up under both expenditure and depreciation I believe.

-

53 minutes ago, DerbyFan said:

We announced the FFP loss in 2015/16 as £9m here

EFL permitted the loan settlement then or? Exceptional items like that don't usually count towards FFP. Still you have said before your youth/academy expenditure quite high, it is a Category One Academy and the figures do bear this out. £9m feels in the right ballpark though if loan settlement excluded it is a bit- based on my calcs and what the accounts show, for £9m assuming loan settlement excluded, then £9,828,810 on Youth Expenditure that year- was there a lot of work done on it 2015/16, the academy? Unless the £9m refers to the Sevco 5112 figures, which I haven't really looked at much yet.

Anyway my calculations- done quickly and will probably require revision:

Total loss on accounts for Derby £47,966,827.

Subtract:

- Infrastructure Expenditure to June 2018- £11,445,434

- Depreciation on Fixed Assets- £9,073,763

- KNOWN Youth Expenditure- we can only guess for 2015/16, something between £4-4.5m? Anyway known youth expenditure would be £8,585,671.

- ASSUMED Womens and Community Expenditure- £1.5m over 3 years seems a reasonable guess? If you have any more info that'd be interesting.

Add back for FFP purposes the loan cancellation/settlement whatever it was £12,433,568.

You definitely pass without Stadium transaction, for Derby County that is. Sevco 5112 if that's used for your 3 year submissions/rolling figure, then it'd be more than likely a different matter without the sale and leaseback.

-

Took a bit of a look at those Derby accounts in full for 2015-16 to 2017/18- not really looked at Sevco 5112 Limited much yet but for the sake of argument let's assume the reason Derby did the Sevco 5112 Limited thing and all the associated companies was because of massaging FFP/accounting figures? Tax efficiency too? This is before/without stadium shenanigans etc obviously!

Derby County 2015/16

Loss- £14,725,353- However included within is exceptional operating income of some £12,433,568. Don't think that should be included for FFP so let's adjust that to £27,589,921? This is headline loss/adjusted loss after player sales, interest reserve etc but before adjustments for FFP e.g. infrastructure, depreciation youth etc.

Derby County 2016/17

Loss- £7,872,715

Derby County 2017/18

Loss £25,368,759

Total losses- before the allowables of course- of £60,400,395.

However allowables now kick in:

2015/16

- £5.815,221 on Infrastructure Expenditure- under Purchase of Tangible Fixed Assets

- £2,445,890 in terms of Depreciation of Tangible Fixed Assets

- No figure for Youth Expenditure- that's as distinct from improvements to ground, academy etc. The average figure for the 2 subsequent years added then divided seemed to be £4.29m per year so let's go with that?

- Let's assume £500,000 in total for Women's and Community?

2016/17

- £4,160,399 in Infrastructure Expenditure- under Purchase of Tangible Fixed Assets.

- £3,176,360 in terms of Depreciation of Tangible Fixed Assets

- £3,961,509 in Youth Expenditure

- Let's assume the £500k still holds.

2017/18

- £1,469,814 in Infrastructure Expenditure- under Purchase of Tangible Fixed Assets.

- £3,451,513 in terms of Depreciation of Tangible Fixed Assets.

- £4,624,162 in Youth Expenditure.

- Let's assume the £500k still holds.

Not done the calcs yet but I think they pass to June 2018 even without ground transaction, albeit not by a huge amount- even if Youth Expenditure in 2015/16, plus Women's and Community expenditure in those three seasons is zero- which I doubt of course.

-

Looking a 2 horse race now- Essex should wrap it up at Trent Bridge- last game of season Somerset v Essex at Taunton- title decider??

Still have moderate hope of a West Country derby in the top flight in 2020 also.

-

Looking like a 2 horse race in Championship?

Essex are at this stage I get the feeling performing somewhat better than 2nd place sides at the equivalent stage in last few seasons- will be hard to get 9 wickets in a day at Taunton?

As for us, Division 2- looks quite open. 2 games in hand on Sussex 19 points off in 3rd, fact we've won 1 game in 7 and yet still have a chance- top 3 go up this season so 3rd place isn't impossible. Could be Glamorgan coming up which would be a turnup! Middlesex languishing at the bottom, sleeping giant if ever there was one, Durham 2nd bottom, but their financial issues playing a part there.

-

1

1

-

-

11 minutes ago, downendcity said:

A friend of mine is an RICS qualified Commercial Valuer. His company manages substantial commercial property assets in and around London.

Im hoping to have a chat with him to find out how a stadium would be valued and will post on here when I have.

Thanks- that'll be very interesting to see, to hear.

If my friend can ever properly navigate the free trial for it- or better yet knows someone who is a valuer, using isurv etc I'll post that too.

As a layman, still thinking in the £50-55m bracket but we'll see I guess...

-

If anyone has a proper subscription to RICS guide for valuation and especially football stadia, that could be very interesting.

A friend tried to get a free trial a while ago but wasn't navigating it so well.

Isurv. Valuation calculations- something like this.

-

5 minutes ago, Bristol Rob said:

Agree with a lot of that, but then you look at Arsenal...

For years it looked like they were going to be the benchmark for sustainable football, frugal in the transfer market, looking to pay off the stadium ahead of schedule and then a new Sky Deal comes along and re-levels the playing field.

A salary cap might be interesting, either in terms of percentage of turnover or a divisional total (divided by club), if you want to bring in another superstar, you might have to let someone else go. Would help with the stockpiling of players at some clubs.

Seems there is no clear answer to this.

Arsenal actually madly could be in some sort of FFP waters- different calculations online but that poster boy of FFP seemed to depend a decent amount on regular CL revenue.

Throw in caution being lifted on fees, wages, general inflation elsewhere playing its part, as you say the Sky deal- Arsenal drop out top 4? One year is okay, 2 years is alright but now they are unbelievably a bit restricted, with a mix of STCC and FFP.

One of the last clubs I thought would be anywhere near this. Because when you subtract profit on player transactions from actual profit, and then the net difference between Europa League revenue and CL revenue, things look different. Hamstrung? Like I say never thought Arsenal might be near or at least in the same ballpark as FFP. Think property revenues don't count towards FFP either- if not that's another that needs to be crossed off the profit.

-

1

1

-

-

22 minutes ago, downendcity said:

Could Reading's sale and leaseback profit be only £6.5 m because it could be based on a proper commercial valuation?

You see, I wondered that- and it is the view that definitely makes sense by far.

My take on Derby's ground sale is that £50-55m, maybe around £56m "feels" about right. Rumours were that Sheffield Wednesday sold for £30m, ground value around £22-22.25m. No idea on Birmingham, whether they've got their act together on it is debatable. Still trying to work out Aston Villa's NBV as they have a certain amount of non-depreciable land.

The recurring theme though, certainly with Reading and if the rumours were true, Sheff Wed is that the profit is somewhere between 25%-35%- that somehow feels right what with additions to tangible fixed assets, land value rises minus depreciation- oh and in 2007 Pride Park was valued at £55m as per their own accounts- my method with it admittedly loose method was take that valuation, take additions and subtract depreciation- not yet got into looking at land prices in that area of Derby etc since 2007.

It's benchmarking after all- something the EFL need to look into as a matter of urgency, well they should have as soon as Derby approached with the proposal tbh. Valuation needs challenging.

-

15 minutes ago, downendcity said:

This is the thing that grates with Villa and Derby.

Both clubs knew the new ffp rules, and that they would come into effect this spring , as did every other club in the division. In Villa's case they had 3 years in which to adjust to financial life in the championship, during which time parachute payments would help make the transition more manageable. Despite this they seemed to carry on as though nothing had changed, paying big money recruiting players that they thought would secure a quick return too the premier league. When this didn't happen, like a desperate gambler , they chased their losses by buying more players and if reports are to be believed they even borrowed in advance of their final year parachute payments.

With all of this, to now say that "they had to do something to avoid breaching ffp" as though it justifies the sale of Villa Park, is putting 2 fingers up to the EFL and every other club that has done something to avoid breaching ffp - namely, managing their affairs to bring costs in line with income.

Similarly, Mel Morris justifies Derby's sale of Pride Park on the basis of it being very difficult to remain competitive, i.e. Derby found it difficult to be as competitive if they had to reduce costs in line with income, thereby reducing the quality of their playing squad, i.e. doing all the things that other championship clubs have been doing in order to avoid breaching ffp.

It now seems that what they both did is allowed within the new rules. The irony is that it would not have been under the previous ffp rules, and this being the case I can't for the life of me think why the EFL made this change. Having said that I agree with you that this summer has shown the eFL to be almost impotent when dealing with big clubs over the application of ffp. I can't help but think that at this early stage they need to review and overhaul the rules at the same time as deciding exactly what they want ffp to achieve, because at the moment ffp seems to be a moving target and it is the clubs that keep moving it.

Agree with all of this. Impotent at dealing with big clubs...or maybe morally speaking colluding?

Derby is an odd case, I am trying to work out if they breach or not- based on the DCFC as opposed to Sevco 5112, without the ground thing. They're somewhere between player sales and ground sales- I'm adding up losses, but subtracting what I assume to be infrastructure spending i.e. spending on, additions to fixed assets-then the youth, community etc expenditure, depreciation. I agree the EFL removing that rule is and was madness.

If I was to give an order of ground sales and their culpability to date ethically etc then right now the disreputability table would look like this IMO:

- Aston Villa- the winners.

- Derby- The ground transaction, but at the same time a number of first team players solid- which leads me onto...

- Sheffield Wednesday- So far no ground transaction reported yet- but no accounts either so we don't know- lack of sales could easily see them and Derby swap places!

-

Birmingham- Yes they breached, yes they were ignorant and arrogant but ground sale combined with Adams, Jota out and Morrison their captain gone on a free, Monk- catching up with them yet in reality it was one

shockingRedknapp season that took them over. - Reading- Under a soft embargo, may well have breached. Yet the ground sale and leaseback profit only £6.5m, which is oddly low indeed. The least bad of the 5, not least as it appears not to have helped them much. Incompetence as with 4 and maybe 3??

-

Those clubs that do the sale and leaseback to a related party, especially with a lack of first team, key departures are cheats- albeit not in a technical sense which is a very important distinction to draw.

In the last few years- in no apparent order and off the top of my head:

US

- Kodjia

- Flint

- Bryan

- Reid

- Kelly

Leeds

- Wood

- Vieira

- Clarke

Middlesbrough

- Gibson

- Traore

- Bamford

Norwich

- Maddison

- Murphy

Nottingham Forest

- Burke

- Assombalonga

- Brereton

Sheffield United

- Brooks

Then there are smaller, or less financially rich but nonetheless compliant clubs- Brentford sell aplenty and have a brilliant system. Preston sold Hugill, Wigan sold Grigg last season which probably helps just keep it ticking over a bit

Like I say it's disgusting. Shameless...EFL changing that rule quietly is morally- but in no way whatsoever legally I must stress- speaking aiding and abetting, enabling.

-

1

1

-

Promised I'd come onto it and come onto it I will.

On the Webster thread you declared that you had to do something to avoid breaching FFP. While I totally get it from a business, technical, regulatory and of course financial POV- from reality, for integrity of the competition it makes a total mockery. Absolute mockery. Other clubs appear to have done sale and leaseback but the big 3 here are yourselves, Derby and Sheffield Wednesday. Birmingham seem to have done a mix of the 2- stupidity but now the sale of Adams and Jota. If St Andrews sale in 2018/19 period and Adams sale too, well they're on one year periods until 2019/20 so they'd still be hamstrung even with a ground sale but would surely avoid FFP sanctions for 2018/19. Reading sold a ground worth £20m to owners for £26.5m, which is strikingly low and doesn't help their FFP all that much.

What else could Aston Villa have done- let's think shall we.

- Sell Grealish

- Keep Grealish but sell say Chester, Adomah, Kodjia- it all can help.

- Sign cheaper loanees.

- Not replace Snodgrass-Grabban with El Ghazi-Bolasie-Tammy.

- Not sign Kalinic and Guilbert in Jan for a combined added amortisation of £1.1m.

- Utilise YOUTH more- utilise it more to help make up shortfalls.

- Utilise squad players more- fair enough if some you loan out help make up a shortfall and you sign cheaper ones making a net profit but you did not in the main.

- Oh yeah, not even mentioned your January loans for Mings-Hause-Carroll!!

Looking at your many, many signings last season the ones I'd say were acceptable from a moving towards compliance POV were as follows:

- Nyland- Not a huge wage probably.

- McGinn- Not a huge wage probably.

- Hause- loan

- Tuanzebe loan- Maybe. Man Utd connection to Bruce perhaps helps with wages- or maybe his wages just are not so high?

Maybe some younger and cheaper loanees- certainly less proven on top.

Now I'm not saying that saves you entirely from FFP but it does what parachute payments are intended to do- and these steps would all be seen as very concrete with potential for significant mitigation, in terms of a point penalty or similar.

What yourselves have done- and Derby, and though there are zero accounts, Sheffield Wednesday is essentially tried to cheat the competition albeit within the revised regs!! Disgusting basically- ******* disgusting. I take back some of what I said about Mel Morris too.

EFL have a hell of a lot to answer for, I actually think clubs should look at legal action against the EFL themselves- mind you why clubs agreed to it as an 18/24 god knows. They certainly kept it very quiet.

Your club has got a lot more dislikable- no personal dig at you, you're a good poster in good faith obviously, but your club since last summer- looking from the outside your new owners seem a lot less likable than Xia, and Purslow? Liverpool fans didn't much like him apparently.

-

1

1

-

Some uncertainty about Sheffield Wednesday.

Apparently their new free transfer signings were spotted at their pre-season event called "Owls in the Park". Odubajo-Borner-Harris. Not bad range of free transfers- think first and third are good and Borner good experienced CB late 20s, Bundesliga 2 and useful on the ball. Bruce would like 4 more apparently. Also extended Westwood-Palmer-Lee- wasn't aware you could under an embargo?

The uncertainty comes because a) Obviously they have not been unveiled officially b) They are apparently under a soft embargo c) Unless anything new has happened in secret which it could well have, the EFL may well lack their accounts from season just gone and d) The big one- no accounts at CH- for 2017/18!!

Originally made up to May 31st 2018, extended to July 31st 2018- these were due on February 28th latterly April 30th 2018- this surely, is there nothing that smacks of aggravated breach here?

Haven't even explored the prospect they may have breached FFP- I'd say there is a reasonable chance they have but we shall see, Jack Hunt aside, who have they sold??

Said it before, any club not getting accounts to EFL by deadline, full summer embargo- end of. Let alone the lack of 17/18 accounts to CH!! Possible of course that ground thing going through, some say accounts not signed off by auditors- either way they should not be in a position to sign anyone at all or even negotiate for frees IMO, while in this position.- hope the EFL have tied up loose ends and refuse to register them for as long as it goes on and if they unveil them while a) 2018-19 accounts with EFL- which they might be now tbf- or b) 2017/18 accounts not with CH, EFL hearing Birmingham style I'd suggest.

Probably just a few isolated idiots, certainly not in the Aston Villa League (Begley excepted of course), but yeah I hope it evolves into a full embargo and maybe a disciplinary hearing at the EFL.

-

So Aston Villa have as mooted sold the stadium then?

Few thoughts:

- Given parachute payments too, nearly £90m in 3 years- wow how dislikable they increasingly are. Had the benefit of that and still needed to do this?? Derby at least sold Grant-Christie-Hughes-Ince-Hendrick-Vydra-Weimann. Birmingham got stung but have now sold Adams and Jota as a result. Who did Aston Villa sell of note?? Not talking foreign players who would have wanted out on relegation, but of note which first team or near first teamers did they sell? Same can be said of Sheff Wed- Jack Hunt the only one, but they didn't have all those parachute payments to help.

- On that note, Parachute Payments really should be conditional on a club making significant efforts to help to balance the books IMO. Aston Villa did not therefore under my system would be fined a proportion of their parachute payments- obviously FFP would still apply as it would to everyone else.

- The ground went for £56.7m right. Was that "gross" or "profit"- if it was the latter it'd be interesting- because only the profit on such sales, as opposed to the total transaction would be of use in this instance- especially if an internal transfer such as this. Anyway their accounts appear to in terms of

- Villa Park- unsure how much it's worth. They probably did sell it for enough to get through FFP. 80-90% profit maybe? Again- questionable.

- This must surely call into fresh question the Pride Park deal. Reading ground worth £20m, goes for £26.5m- though only 24k capacity, similar modern build and 1998 was its completion date as opposed to Pride Park which was 1997. The next bit is a RUMOUR- but Hillsborough apparently gross sale price around £30m- current value based on 2013 valuation around £22-22.25m. Margin about 1/3 on each.

- EFL or perhaps I have more faith in club owners with hefty resources and proper business nous need to get some sort of inquiry going- to challenge the valuation, the profit based on benchmarking, hire some high end valuers and lawyers- these things can be legally challenged but it ain't easy!

Someone mentioned projected accounts. It's possible that they had this in their projected accounts- highly unlikely but possible that they had it as a fallback plan in these in case of no promotion.

8 hours ago, Sturman 1 said:I would be interested in seeing how we look in regards to FFP after this window, £14mill made on transfers but for players on a low(ish) wage in comparison to the new additions coming in that I would imagine be on top £££.

Fine I reckon. Not saying we can go nuts- we cannot- but the profit on Flint and the academy lot, the savings on amortisation on some others- all a big help. The Kelly sale likely would fall in the 2018/19 accounts, the savings this season to date would be there but not huge- Fielding, Marinovic, Pisano wages and possibly a small profit on Eisa. However our 3 year position is decent but again that £24m loss in 2017/18- before allowables-has to be kept in mind. OTOH we should've made a profit last season, the Kelly sale making absolutely sure- the bigger the profit the more we can spend in the subsequent window or 2. As I say can't go nuts but by the end of this season, that aforementioned £24m loss- so summer 2020 basically, June 1st 2020 this will drop off and our new starting point will be summer 2018 and the restructure.

I don't have any particular concerns about breaching it with SL, MA and LJ at the helm.

-

2

2

-

1

1

-

8 hours ago, GreedyHarry said:

So in theory, a club or owner could sell their stadium on every season to a new company, and cover their losses? They could even get the club to buy each stadium owning company for a pound before repeating the trick over and over. No point in FFP at all now if this is the case, as it is completely meaningless.

Taxman/HMRC may have something to say about it.

Pretty sure they'd have more than FFP to worry about then- definitely couldn't happen like that IMO.

-

1

1

-

-

59 minutes ago, DerbyFan said:

I mentioned this in post 678, I actually quoted that particular section of the rules! (1.1.2 and (a))

The old rules (from the first tweet) are the ones in Part 1 on the EFL website, they relate to 2015/16. The new rules (from the second tweet) are the ones in Part 2 they relate to 2016/17 onwards.

The old rules seem to only be there as a reference because the year 2015/16 was included in the 3 year rolling period leading to 2017/18.

Thanks- I'll have a look at them in depth later, they do ring a bell actually from this thread.

Still unconvinced by the valuation personally- seems sale and leaseback in the regs, but £81.1m just feels too high- always had it in the bracket of £40-50m, maybe £55m- still think the profit size should be challenged by EFL- their own independent valuers etc. Paid for by the EFL of course.

Reading- value around £20m, sale pride £26.5m. Margin/ratio about 1/3.

If rumours to be believed- Hillsborough sold for £30m- shown in accounts as a 2013 revaluation of £22.25m, margin/ratio about 35%.

Well aware that Pride Park is bigger than Madejski Stadium and a fair bit better, more modern than Hillsborough, plus property prices in Derby so therefore land value higher than Sheffield but I'm thinking about £40-55m about right- based on 2007 valuation which was just that. Add on the additions to Tangible Fixed Assets which presumably represents work being done on it, subtract the depreciation- would property price rises shunt this up to £81.1m?

Using historic figures and benchmarking etc, it just "feels" too high- not the fact there is an uptick but double!!

-

Alas, seems it is within the updated regs.

People call it a loophole but actually seemingly it's one enabled by the club owners, the EFL- did 18/24 vote for this then?

Will have to look through the new regs- first I've seen a lot of those actually. Part 2 onwards would appear to be the updated/most recent/relevant.

I still wonder if the ground sale and leaseback might be challenged and adjusted- not excluded but adjusted- for FFP purposes what with Gibson's. Would need a full and far reaching inquiry though.

Example A- Reading. Their ground was worth around £20m, income from sale and leaseback to owners £26.5m- that's about 32.5% profit margin. Bear in mind Madejski built similar time to Pride Park and adjusted for inflation, £50m to build today.

Example B- saw a rumour that Hillsborough gross figure was £30m- profit margin about 1/3.

To me either of those might pass the "smell test"- I don't approve of any of it but it feels like 25-35% uptick what with post 1992 developments of grounds, new builds, further work, property rises and inflation adjustments- might be within the bounds of normal. Double though, or as good as double? Just struggle to see it, given valuation in 2007 was £55m- unclear what revaluation in 2013 might have been- but for subsequent revaluation I've been taking £55m as a starting point, adding on extra work i.e. additions under Tangible Fixed Assets and subtracting depreciation.

-

37 minutes ago, downendcity said:

Steve Lansdown also realised that there wasn't enough revenue to sustain a competitive club, so set about improving revenue and managing costs through the club's strategy around player purchases and use of the academy.

These decisions were made with full realisation of the impact of ffp and that the club had to work within those parameters. It also meant that the plans would not have immediate impact and effect but would take time for the club to be properly competitive at the top end of the table, and in the meantime would test fans' patience .

For all that Mel Morris is a Derby fan and wants the best for his club ( as does SL) he is basically saying that he's not prepared to wait, wants success now and is prepared to pay for it and will break the rules in order to do so. He's also saying stuff all the other clubs that are affected by the same issues but are going about things the right way in order to stay within the same set of rules that he seems to regard as being unfair and restrictive to the club soon to be known as Formerly Frank Lampard's Derby County.

Sorry but that makes him a cheat in my eyes, no matter how "interesting' he might be..

Oh I don't like the ground sale at all- Aston Villa certainly the worst of the 4 likely big FFP botherers- by far, but this is a very good post.

Agreed.

The thing about Derby and where they differ to other clubs- by which I mean Aston Villa, Birmingham and seemingly Sheffield Wednesday- we don't know either way yet as still no accounts for 2017/18- was the first team and squad players they sold- seemed like a move to buy time for a restructuring rather than a big FFP dodge/cheat to me- but then it comes down to which accounts used for Derby's FFP submissions as well, is it the Derby County ones or the Sevco 5112 Limited?

If the latter then yes FFP failed for sure without it, if it was the former then there's a small chance they pass. I've looked over their 3 year figures for Derby 2015/16-2017/18 and it really wouldn't have been a done deal that they fail to June 2018 with the DCFC accounts- grey area. Sevco 5112 though, absolutely it was FFP related! I hope they have to go through some austerity times though, if not fall foul of FFP.

It isn't right I agree- he's usually a good listen though.

@DerbyFan Thanks- will take a listen. The bit about events bringing in £12m per season sounds notable, like you are looking to stick strictly within the regulations in the future. Also do you know if it is "The Derby County Football Club Limited" or Sevco 5112 that is used for FFP submissions?

-

Mel Morris has defended the stadium sale and leaseback on TalkSport- saw it on another forum.

QuoteQ: "[Stadium buy] Was that naughty?"

MM: "There simply isn't enough revenue to sustain a competitive club..."

Also added:

QuoteMM: "The starting point for this is: do you want to own a football club and just be mid-table or compete? Because there's a massive difference in expenditure. Money talks. Last year was an exceptional year, credit to Norwich and Sheff Utd. It is a rarity, though. Costs of running a football club are entirely proportionate to the aspirations. 9 clubs (this season) in the Championship will have parachute payments."

Think he's pretty engaging, pretty interesting tbh- and a good owner who is clearly a Derby fan- just a shame about the ground sale and leaseback!!

Dunno if it's a direct quote or a summary but this bit was also of interest, on the financial side.

QuoteThere was a moment where he spoke about parachute payments and essentially FFP "not letting" people invest if they wanted to in order to compete with the relegated teams

Like I say, the ground move is not one I much care for at all but an interesting owner definitely.

-

1

1

-

The County Cricket Thread

in General Chat

Posted · Edited by Mr Popodopolous

Partnership BROKEN.

Two quick wickets...if we can keep Middlesex to 200 or so, it maybe on. Not much margin for error though, the lead 194.